boulder co sales tax return form

Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. The city of boulder requires all organizations and businesses coming into boulder for special events to obtain a city of boulder business license and file a sales use tax return.

Sales And Use Tax City Of Boulder

SALES TAX RETURN You must file this return even if line 15 is zero Note.

. If return is filed after due date add. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. Box 407-Taxable sales times 2 002 a Flatiron Improv.

BOX 791 BOULDER CO 80306 303441- 3288. Sales tax returns are due the 20th of the month following the month reported. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations.

15 or less per month. Boulder co sales tax return form. All payments of Boulder County sales tax should be reported through CDORs Revenue Online or through CDORs printable forms found at CDORs website.

In-City fillable form SalesUse Tax Application Outside-City fillable form SalesUse Tax Application. Include photos crosses check and text boxes if it is supposed. Publication 32 titled gifts premiums and prizes states purchases of tangible personal property for use as gifts premiums or.

Salestaxbouldercoloradogov o llamarnos a 303-441-4425. If you have any difficulties switch on the Wizard Tool. DR 0235 - Request for Vending Machine Decals.

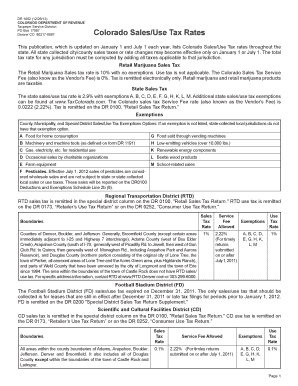

Navigating the Boulder Online Tax System. Under 300 per month. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

Masks are required in all indoor public settings in Boulder County for everyone age 2 and older regardless of vaccination status. Sales tax returns may be filed quarterly. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

DR 0100 - Retail Sales Tax Return Supplemental Instructions DR 0103 - State Service Fee Worksheet. Httpsbouldercoloradogovtax-licensesales-and-use-tax for more information on tax and licensing including tax rates tax guidance and FAQs. CR 0100AP - Business Application for Sales Tax Account.

Information about City of Boulder Sales and Use Tax. Purchase of Existing Business. You will receive useful tips for easier submitting.

Fill in the info required in CO Sales Tax Return - City of Boulder making use of fillable fields. Blank SalesUse Tax Return 2011-2017 Blank SalesUse Tax Return. COMPUTATION OF TAX 10 A 13 A Amount of city sales tax 3 of line 4 Add excess tax collected Adjusted city tax add lines 5 and 6 Unused Unused City use tax.

Return the completed form in person 8-5 M-F or by mail. Repeating info will be filled automatically after the first input. Filing frequency is determined by the amount of sales tax collected monthly.

All payments of Boulder County sales tax should be reported through CDORs Revenue Online portal or through forms found at wwwcoloradogovrevenue. A tax return must be filed even if there is no tax due. Amount subject to 3 use tax from Schedule A see side 2 Additional use tax 3 see side 2 Schedule B TOTAL TAX DUE add lines 7 IOA and 10B Late filing.

Boulder Online Tax System. The County sales tax rate is. Para asistencia en español favor de mandarnos un email a.

Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. Valid returns are those generated by Boulder Online Tax and will include a media.

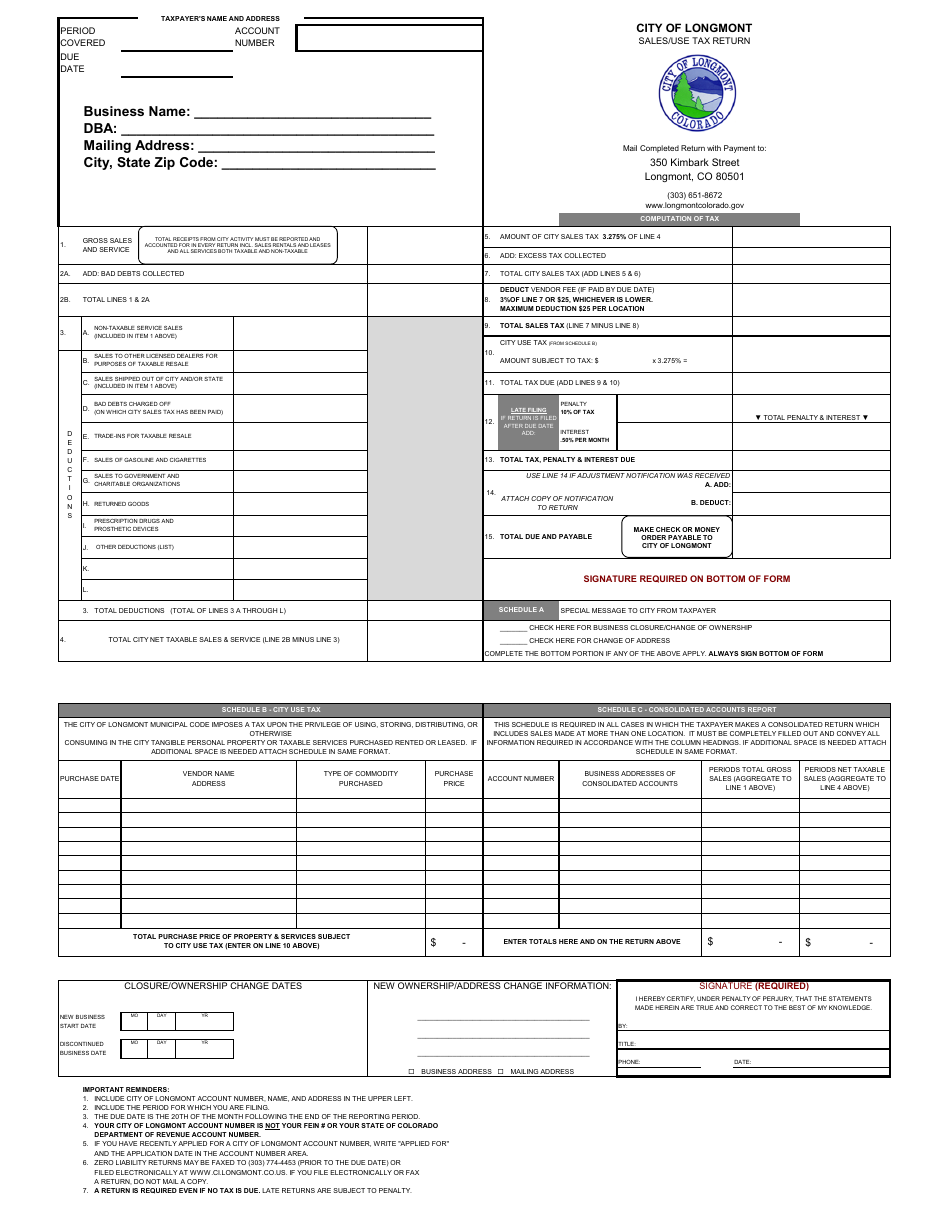

Annual returns are due January 20. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. Show details How it works Open the boulder online tax gentax cpc and follow the instructions Easily sign the sales tax return boulder with your finger Send filled signed city of boulder sales tax return or save.

Boulder Revised Code 3-2-1b and Tax Regulation 43. Wayfair Inc affect Colorado. Get and Sign City of Boulder Sales Tax Form Get started with a boulder online tax 0 complete it in a few clicks and submit it securely.

DR 0154 - Sales Tax Return for Occasional Sales. For questions about city taxes and. Broomfield CO 80038-0407 FILING PERIOD Required Returns not postmarked by the due date will be late CITY COUNTY OF BROOMFIELD Sales Tax Administration Division PO.

Subcontractor Affidavit Page 2 1777 BROADWAY PO. FID Taxable sales times 01 0001. If you need additional assistance please call 303-441-3050 or e-mail us at.

This is the total of state county and city sales tax rates. How to Apply for a Sales and Use Tax License. About City of Boulders Sales and Use Tax.

The Colorado sales tax rate is currently. Beginning with sales on January 1 2018 the Colorado Department of Revenue CDOR will be requiring ALL Colorado sales tax licensees to report and. The Boulder sales tax rate is.

Sales tax returns may be filed annually. Subsequent use tax liabilities are reported on the City of Boulder SalesUse Tax Return which is filed on a routine basis. Sales tax returns are due the 20th of the month following the month reported.

Purpose of Form The Initial Use Tax Return is required to be filed by any person who purchases or establishes a business in the City. Paper Filing Taxpayers that choose to file tax returns by printing the form generated through Boulder Online Tax and personally deliver or mail with payment. The minimum combined 2021 sales tax rate for Boulder Colorado is.

Did South Dakota v. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City.

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Download Form P87 For Claiming Uniform Tax Rebate Dns Accountants Tax Refund Tax Accounting

Colorado Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

Https Www Hrblock Com Tax Center Irs Audits And Tax Notices Irs Notice Cp11 2020 06 08t22 14 49 00 00 Https Www Hrblock Com Tax Center Wp Content Uploads 2017 06 Cp11 Png Irs Notice Cp11 Https Www Hrblock Com Tax Center Irs Audits And Tax

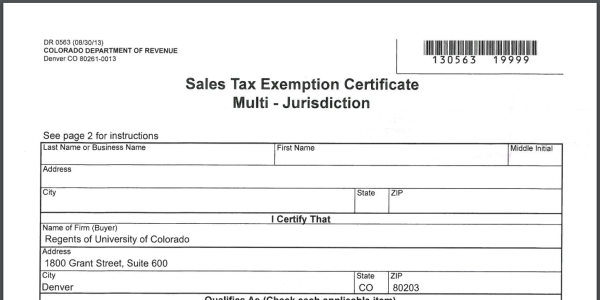

Sales Tax Campus Controller S Office University Of Colorado Boulder

Https Www Hrblock Com Tax Center Irs Audits And Tax Notices Irs Notice Cp11 2020 06 08t22 14 49 00 00 Https Www Hrblock Com Tax Center Wp Content Uploads 2017 06 Cp11 Png Irs Notice Cp11 Https Www Hrblock Com Tax Center Irs Audits And Tax

Https Www Hrblock Com Tax Center Irs Audits And Tax Notices Irs Notice Cp11 2020 06 08t22 14 49 00 00 Https Www Hrblock Com Tax Center Wp Content Uploads 2017 06 Cp11 Png Irs Notice Cp11 Https Www Hrblock Com Tax Center Irs Audits And Tax

Irs Letter 39 Tax Return Not Received Credit On Account

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Vacation Rentals Huge Rents Any Profits Rental Property Vacation Rental Management Vacation Rental

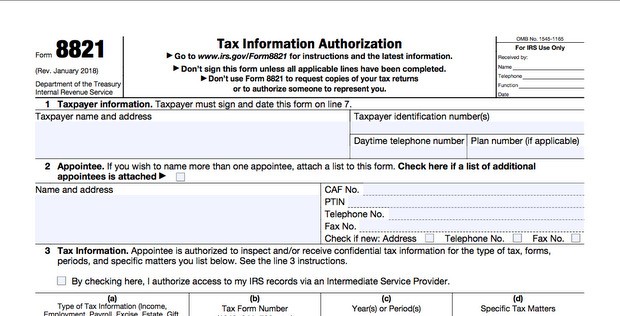

What Is Form 8821 Or Tax Guard Excel Capital Management

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

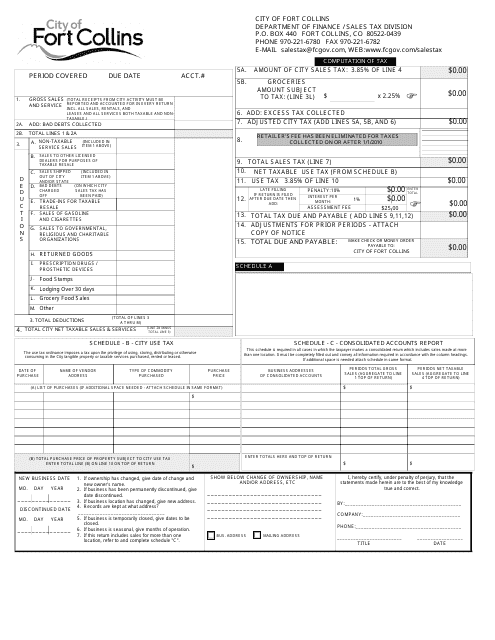

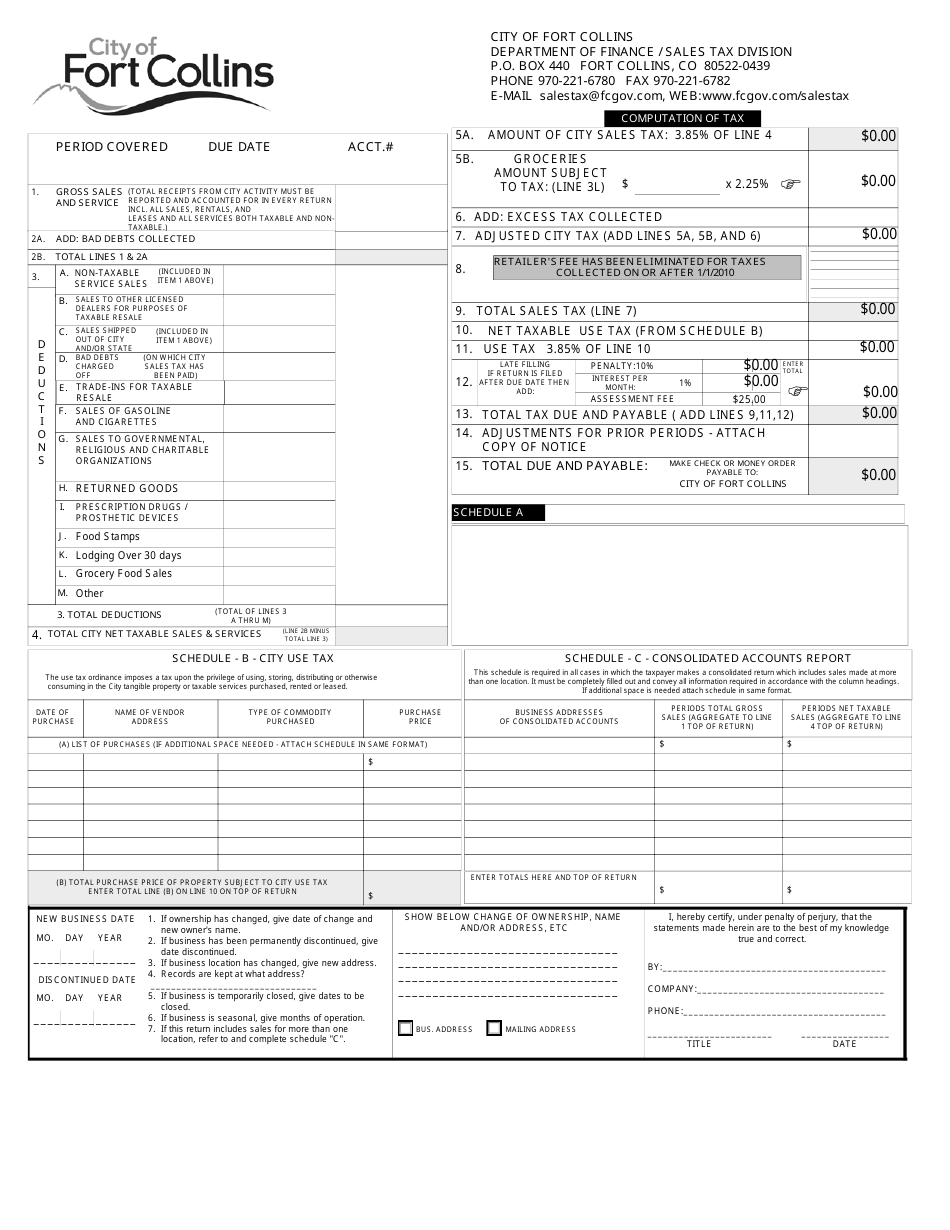

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Filing Information Department Of Revenue Taxation

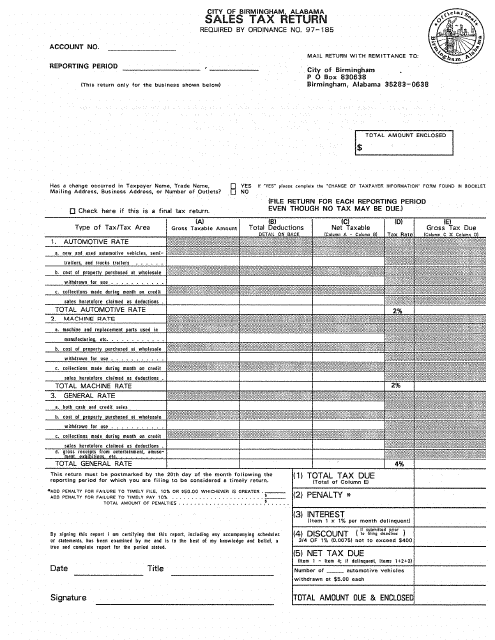

City Of Birmingham Alabama Sales Tax Return Form Download Printable Pdf Templateroller

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller